To start with-dwelling purchaser sector complexity unveiled | Australian Broker News

News

1st-dwelling client market place complexity unveiled

CoreLogic information reveals nuanced receive troubles

Eliza Owen (pictured earlier talked about), head of family analysis Australia at CoreLogic, analysing Ab muscular tissues housing finance data, underscored the escalating impediment confronted by 1st-property potential consumers in Australia’s hovering real property trade.

In spite of a significant maximize within the CoreLogic Dwelling Value Index by round 150% over the previous two a few years, wages haven’t saved tempo, mounting solely 82% in accordance with the Ab muscular tissues Wage Value Index.

The disparity has widened the opening in home affordability for initial-time shoppers, mirrored by “a deterioration in affordability metrics and an improve within the common age of 1st home potential consumers greater than time.”

Deceptive surge in finance

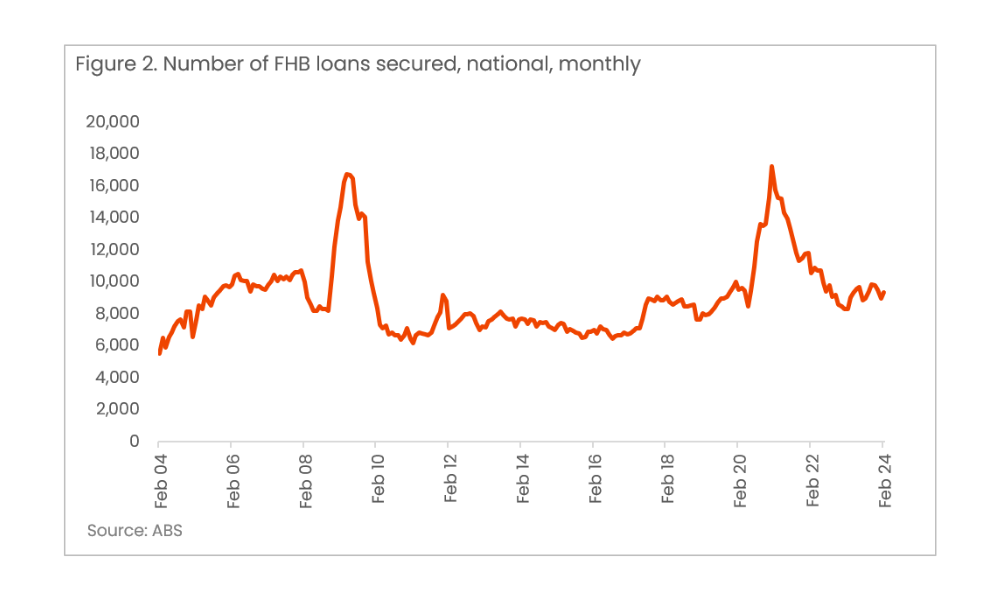

Even although the ABS’ lending indicators info from February confirmed a considerable $4.9 billion secured by very first-residence clients, up 4.8% from the prior month, the decide doesn’t primarily level out enhanced accessibility.

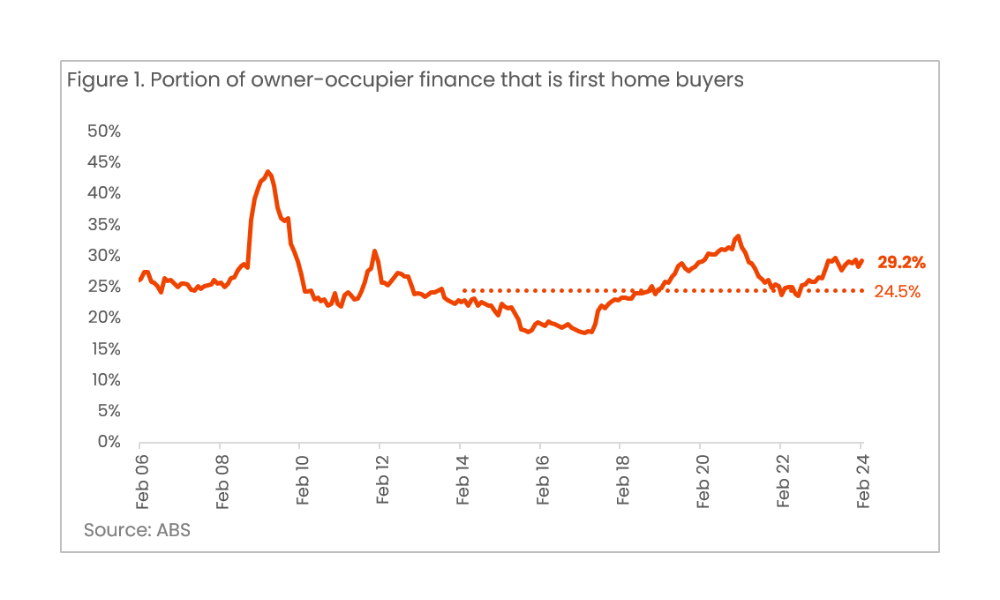

The particulars may counsel 1st-house purchasers are beginning to be a bigger sized a part of {the marketplace} with 29.2% of all proprietor-occupied finance, however as Owen identified, “Does this signify very first-residence potential consumers are buying it so much simpler to purchase residence? Not essentially.”

Contextualising finance progress

The enhance in 1st-house purchaser finance is contrasted by the slower progress or drop in non-initially-household buyer finance, skewing the entire {photograph}. More than the earlier 12 months, the good thing about initial-dwelling client lending has surged by 20.7%, quadrupling the once-a-year improvement worth of non-1st home buyer proprietor-occupier lending, which stands at 5%.

“The enhance within the share of initial-dwelling buyer finance has been exacerbated by comparatively delicate enlargement in non-very first-home buyer proprietor occupier finance,” Owen reported.

The relative measurement indicated additional in regards to the trade dynamics than a genuine enhance in 1st-residence purchaser participation.

Actual picture of initial-dwelling buyer loans

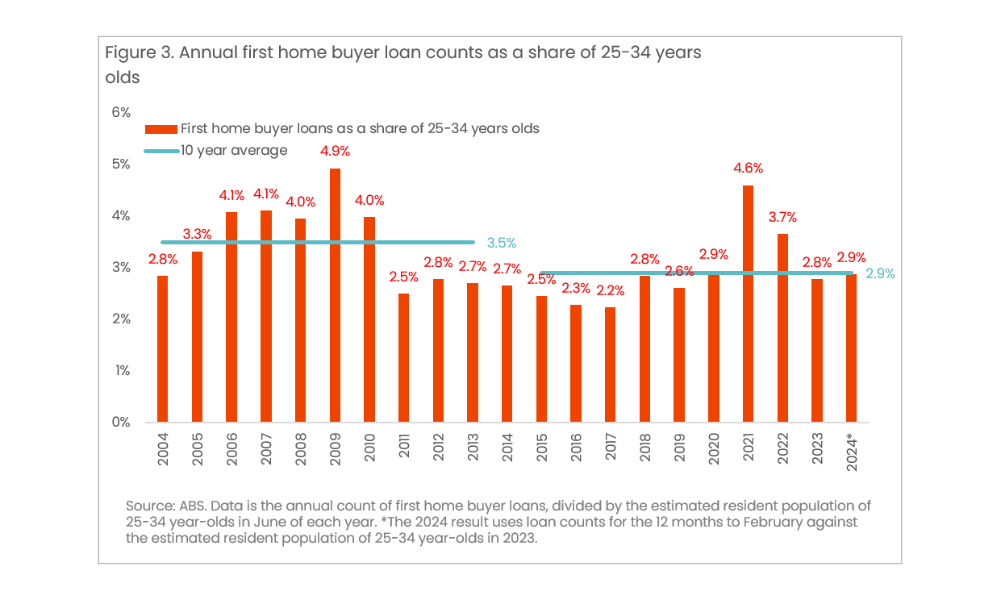

Despite appearances, the exact number of first-household buyer loans secured is presently beneath the doc larger of 2021, with main fluctuations primarily attributed to non everlasting authorities incentives.

This cyclical pattern fails to current a safe basis for sustained very first-household client market entry, particularly when considering the broader monetary panorama impacting dwelling values and trade competitiveness.

Influence of governing administration incentives

Momentary authorities incentives these because the very first family proprietor grant and the HomeBuilder grant have traditionally designed spikes in 1st-home buyer exercise. Nonetheless, these are noticed as synthetic boosts that don’t provide extensive-term help or affordability.

“These grants look to have a momentary affect on very first-residence purchaser portions and will presumably simply convey ahead demand from clients for these that might have purchased into the present market at a afterwards date,” Owen mentioned.

Get one of the best and freshest residence finance mortgage information despatched appropriate into your inbox. Subscribe now to our FREE on a regular basis publication.

Continue to maintain up with the most well liked information and conditions

Sign up for our mailing record, it’s free!