In a serious shift that impacts equally the housing present market and dwelling mortgage establishments like Evergreen Household Loans, the Federal Open Marketplaces Committee (FOMC) has launched the routine upkeep of its short-term coverage curiosity value between 5.25% and 5.5%. This conclusion, declared on Wednesday, marks the fourth time in 2023 that the FOMC has paused charge hikes, adhering to 11 raises provided that March 2022.

Federal Reserve Chairman Jerome Powell, addressing the current financial native climate, indicated an expectation of three 25 foundation degree reductions in charges all through 2024. This strategic shift alerts the conclusion of cost hikes and a brand new interval in monetary plan, probably bolstering monetary funding self-worth.

Responding to this progress, the bond market place noticed a fall in the 10-calendar 12 months Treasury yield to 4.%, a low contemplating that late July. Experts, comparable to Mike Fratantoni from the House mortgage Bankers Association, interpret this as an conclusion to discussions about extra degree hikes, focusing moderately on the extent discount tempo. This is predicted to positively have an effect on housing and mortgage mortgage markets, presumably main to decrease home mortgage costs and spurring modest progress in dwelling income for 2024.

Evergreen Home Loans, a vital participant in the house mortgage sector, has been intently checking these developments. “The Fed’s choice aligns with our expectations and bodes completely for homebuyers and the over-all housing market place,” states a spokesperson from Evergreen Household Loans. “We foresee an uptick in dwelling finance mortgage actions, together with refinancing, as charges change into much more favorable.”

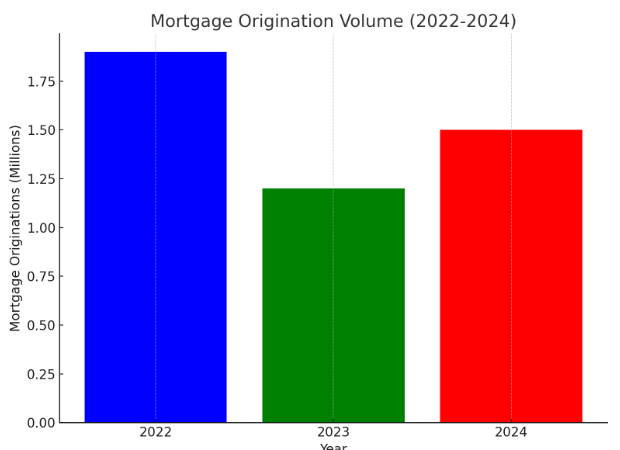

Through 2023, the Fed’s degree hikes impacted a number of sectors, with the mortgage mortgage market remaining particularly influenced. TransUnion research a 37% 12 months-in extra of-year reduce in dwelling mortgage originations. Evergreen House Loans, nonetheless, has navigated these challenges by concentrating on purchaser-centric options and anticipates a way more favorable ambiance in 2024.

Selma Hepp, chief economist at CoreLogic, notes that regardless of a potent November careers report, indicators of financial cooling are apparent. This incorporates slower job development and modest rises in unemployment charges, hinting at a way more restrained financial outlook for the next calendar 12 months.

Hunting in advance, the anticipation of cost cuts in 2024 delivers a helpful outlook. The Primary Mortgage Marketplace Survey index by Freddie Mac, which stood simply greater than 7% currently, is predicted to lower extra, delivering help to price-sensitive homebuyers.

Evergreen House Financial loans echoes the sentiment of Realtor.com Main Economist Danielle Hale, anticipating mortgage mortgage charges to fall to about 6.5% by 12 months-end 2024. This lower would drastically benefit these folks with current significant-fee dwelling loans, opening up alternatives for refinancing and bigger affordability.

Michele Raneri, VP of U.S. investigation and consulting at TransUnion, highlights the possible value financial savings for householders with a degree fall to five.5%. This might point out appreciable each month monetary financial savings, releasing up strategies in a superior value-of-living environment.

In conclusion, the Fed’s continuous strategy and future cost cuts are seen as a optimistic development by Evergreen Residence Loans and different market avid gamers, paving the best way for a much more full of life housing trade in 2024.

Source: HousingWire