Penned on 24 May probably 2023 by Ray Boulger

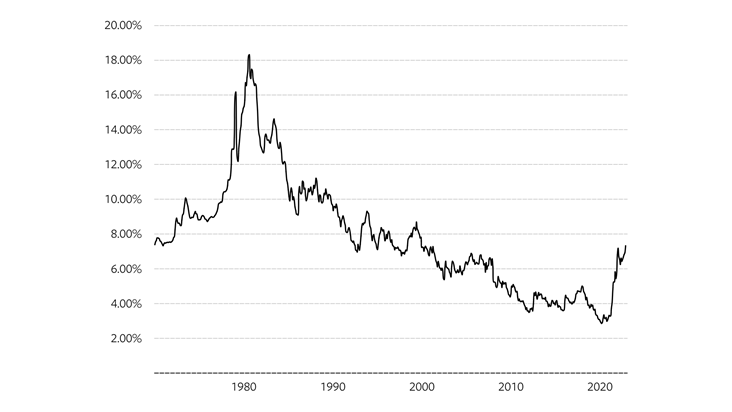

Though present-day CPI figures display a drop to 8.7% the autumn was fewer than predicted and extra worryingly core inflation elevated from 6.2% to 6.8%. The comment within the minutes of the earlier MPC assembly that whether or not or not any extra improves have been required in Lender Rate would depend on the information has now been comprehensively answered, leaving a dialogue solely on whether or not or not 4.75% will present to be the height.

With quite a lot of residence loan debtors buying fixed their costs for five yrs, and a handful of for for an extended time, any additional extra raises in Financial establishment Amount will select a very long time to have a product impression on a number of debtors. A larger extra fast impact will likely be within the industrial market place, the place lots of the monetary loans are Lender Amount trackers, and the have an effect on on individuals imagining of transferring residence or acquiring for the primary time.

This want to have a opposed impression on residence worth ranges, which is most likely what The Lender would really like to see, delivering it doesn’t go far too significantly, because it lessens individuals’s capability to commerce up or use the equity of their residence for purchaser purchases. Also, some doable FTBs who’re even now succesful to afford to purchase may have their confidence sapped.

The immediate affect of right this moment’s inflation figures was a pointy rise in gilt yields, with, even with a few of the unique elevate getting been reversed, on the time of crafting, the two calendar 12 months up 21bp to 4.31% and the 5 yr up by 13bp to 4.11%. These improves abide by varied days of appreciable rises and in regards to the previous thirty day interval gilt yields have risen by about .5%.

The knock on impression on bigger swap costs, and for that reason fixed price pricing, will feed via to the price of mounted degree residence loans fairly promptly and so anyone inside simply 6 months of their fastened quantity ending, or scheduling to apply for a brand new mortgage, ought to communicate to their complete of sector dealer asap to protected a quantity or be properly ready to sit it out for a number of months within the expectation that premiums begin to fall afterwards this 12 months or early subsequent.

Class: Ray Boulger