Comprehension the Recent Housing Market

For a variety of, the want of possessing a home or upgrading to a brand new one specific is accompanied by a mix of pleasure, anticipation, and sometimes, apprehension. The fluctuating nature of home fees might be an emotional rollercoaster, significantly when necessary each day life choices hinge on these figures.

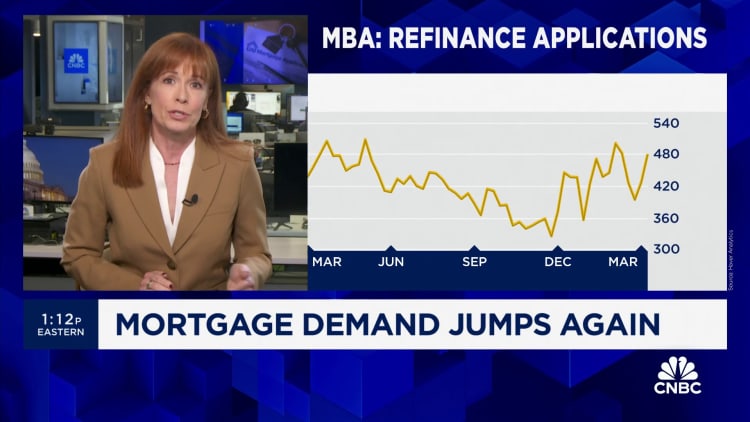

If new headlines have made you hesitant about coming into the housing sector because of fears of dropping dwelling charges, we’re right here to present some readability. Opposite to some beliefs, home fees should not on a downward trajectory. Nationwide data paints a distinct picture, showcasing a reliable enhance in dwelling values this 12 months. Just purchase a search at the graph down under:

Breaking down the graph:

In the early fifty p.c of 2022, there was a noticeable spike in dwelling fees. Having stated that, this kind of sharp raises are usually unsustainable.

The latter half witnessed a fragile correction, inflicting a slight dip in charges. Though small-lived, media protection amplified these dips, major to uncertainty amongst potential purchasers and sellers.

Rapid ahead to 2023, the tide has modified once more. Prices are on the rise, however at a steadier and additional sustainable stage.

Orphe Divounguy, a famend economist from Zillow, elaborates:

“The U.S. housing business has surged greater than the earlier 12 months instantly after a short lived hiccup from July 2022-January 2023. The short-term downturn is now driving us, with the market exhibiting outstanding resilience in 2023.”

As we transfer much more into the calendar 12 months, it really is typical for family promoting worth growth to average. Having stated that, it’s actually vital to distinguish amongst slowing growth and true depreciation. A deceleration in appreciation is even now beneficial development.

Why this surge in home worth ranges?

At its core, it may be a make a distinction of provide and demand from clients. The market place at the second has fewer properties obtainable than there are fascinated purchasers. Superior property finance mortgage charges, although dampening some purchaser want, have additionally lowered the quantity of residences accessible. This is usually due to to the home mortgage cost lock-in outcome: house owners are hesitant to supply and forfeit their decrease mortgage charges for larger sorts on a brand new dwelling. Freddie Mac aptly summarizes:

“Rising curiosity fees have the two dampened want and lessened present. Nonetheless, the lowered supply has had a much more pronounced affect, most important to increasing dwelling charges.”

What does this indicate for you?

Consumers: If apprehensions about reducing family values saved you on the sidelines, it’s actually heartening to know that fees are trending upwards. Homeownership continues to be an expense that usually appreciates about time.

Sellers: If you’ve got received delayed promoting your home as a consequence of value worries, now could be the correct time to work together with a real property certified. Present-day information is in your favor.

In Summary

Ought to you have got paused your residence applications due to promoting worth worries, know that the nationwide sample is demonstrating an uptick in family values. Let us contact base to concentrate on how this circumstance is taking part in out in our neighborhood sector. We are proper right here to tutorial you nearly each stage of the method.

Source: Preserving Existing Matters