Listening and appearing on brokers’ suggestions is significant to the power and success of the non-major financial institution sector.

Second-tier banks rely closely on the third social gathering channel to supply a gentle supply of lending for his or her enterprise.

In a extremely aggressive lending market, brokers are main the cost over the direct to buyer phase. Broker market share is at a file excessive, with the MFAA reporting in April that 71.8% of all new residential residence loans have been written by brokers within the December 2023 quarter.

Non-major banks have taken a proactive method to dealer relationships, working intently with them to help 1000’s of shoppers as they roll off low fastened charges onto greater variable charges.

They are additionally constructing new tech platforms and investing in workers to make sure the whole lending course of is environment friendly, quick, straightforward to make use of and meets the wants of brokers and their clients.

Retention is the important thing and this may be achieved by constantly delivering for brokers and purchasers.

Non-major financial institution leaders know that development and success can’t be reached with out the buy-in of brokers and that’s why they’re eager to work with them and achieve their suggestions.

MPA invited third social gathering leaders from main non-major banks to affix its annual business roundtable at Sydney’s Silks restaurant. Attending the occasion have been Troy Fedder (Suncorp Bank); Paul Herbert (AMP Bank); Johnny Lockwood (BOQ Group) and Ian Rakhit (Bankwest). George Thompson of ING Australia was unable to be there in particular person, however supplied his feedback in writing.

Two brokers additionally attended – Deborah Brincat from Aussie Parramatta and Stephen Michaels of Catalyst Advisers.

Q. Non-major banks confronted plenty of challenges in 2023, together with rising rates of interest and inflation and the fastened charge cliff. How have you ever dealt with these and different challenges, particularly in partnership with brokers?

Troy Fedder (pictured beneath), appearing government common supervisor of residence lending at Suncorp Bank, agreed that 2023 offered plenty of challenges for the business.

“It additionally had some tailwinds,” Fedder mentioned. “I believe one of many great issues for the dealer business is, no matter challenges, the dealer mannequin continues to shine.

“For Suncorp Bank, the phrase partnership is de facto essential – the truth that as a non-major, you’ll be able to genuinely companion with the dealer group to take care of our clients.”

Fedder mentioned in an atmosphere of rising rates of interest “we should always acknowledge that some clients are doing it powerful”.

“I’ve been actually grateful to witness how Suncorp Bank’s relationship with brokers has continued to develop over the previous few years. The quantity of brokers we work with has helped develop our buyer base and allowed us to supply higher outcomes for our clients.”

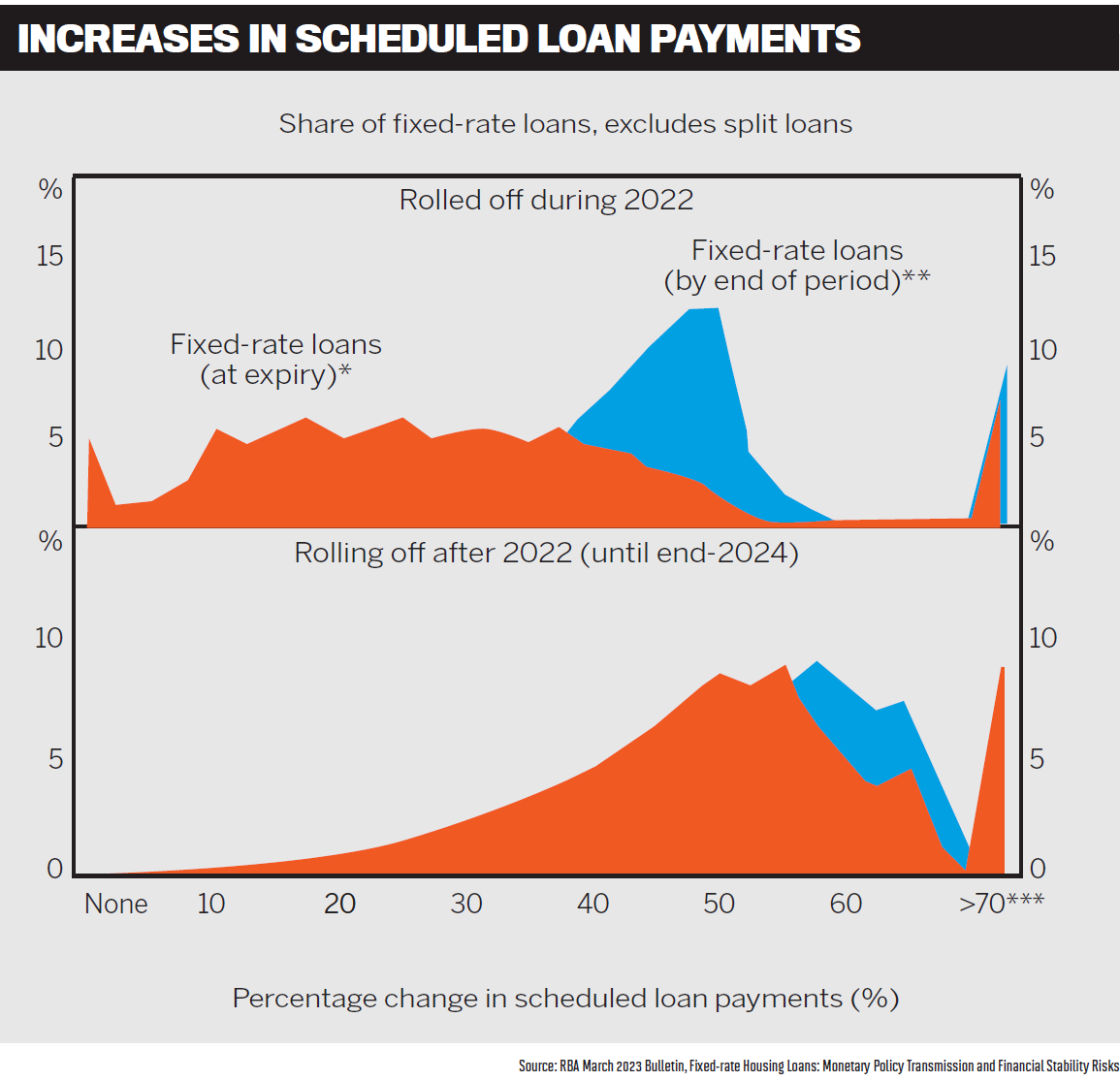

Johnny Lockwood (pictured beneath), BOQ Group common supervisor dealer and strategic partnerships, mentioned there had been 13 rate of interest rises since May 2022, with plenty of fastened charges maturing, and brokers had helped clients deal with these challenges.

“A variety of clients on the market could not service with different banks, so it’s essential for us to proceed to honour each buyer relationships and dealer relationships,” Lockwood mentioned.

This meant having good retention insurance policies and helping clients to deal with charge rises.

Lockwood mentioned BOQ Group had been proactive in educating clients about what fastened charge maturities meant for them.

“We’ve bought navigation hubs, we’ve bought plenty of proactive engagement with clients to assist them perceive their choices.”

The lender additionally reached out to clients vulnerable to hardship “to clean the touchdown for them”.

Lockwood mentioned it was essential for brokers to know that their clients could be sorted.

“I’ve observed over the past six to 12 months that when a dealer asks what are you good at, they need to learn about your retention insurance policies.

“It’s not about what’s your lowest charge after which contemplating one other lender in a number of years’ time. Brokers need to put clients into real, good, and long-lasting relationships.”

AMP Bank head of middleman distribution and finance, Paul Herbert (pictured beneath), mentioned the method it had taken over the past 12 to 18 months had been to focus on educating clients and brokers.

“Informing them that that is arising, that is what we’re going to do, that is what the speed goes to do,” Herbert.

“We’ve been actually early with our communications to clients, to provide them as a lot discover as potential to assist put together for the upper rate of interest atmosphere. We labored with brokers and clients, guaranteeing we gave them a aggressive charge for that point primarily based on broader competitors.”

Herbert mentioned plenty of brokers had spoken to AMP Bank about their retention and rollover conversations with clients, explaining precisely what their fortnightly funds could be as soon as fastened charge phrases ended.

“It’s all about being clear and upfront in these direct-to-customer conversations that we’ve supported brokers with. We discovered that had a extremely constructive impression.”

It additionally meant brokers might produce other conversations with clients to find out if that they had the fitting mortgage buildings in place.

“That was a extremely essential step change that we took to assist clients by that transition,” Herbert mentioned. “Pleasingly, the roll-off of shoppers leaving AMP has been fairly low by that transition interval, as has the arrears.”

While this completely different method to buyer dialog required extra work, Herbert mentioned it had been worthwhile.

George Thompson (pictured beneath), head of mortgages at ING Australia, mentioned the financial uncertainty and rate of interest atmosphere had challenged many Australians.

He mentioned from an ING and a dealer perspective, they mixed on efforts to assist and reassure clients.

This included breaking down all the data to clarify what it meant to the shopper, particularly those that have been going through difficulties, displaying clients how ING might help them and the steps clients might take, and informing them what choices have been accessible.

“We began reaching out to fastened charge clients final yr, following a well-thought-out course of that concerned pre-emptively speaking to clients about budgeting and different useful instruments,” Thompson mentioned.

“As the time to a hard and fast charge expiry attracts nearer, the crew makes outbound calls to clients to make sure they’ve all they should make a well-informed choice. This essential funding helps clients to be greatest ready.”

Lockwood mentioned brokers have been receptive to banks being proactive in dealing with fastened charge maturities.

He mentioned prior to now these conditions concerned “some churn”, but when there have been extenuating circumstances it meant brokers talked to banks and clients and got here up with different options.

Catalyst Advisers managing director Stephen Michaels (pictured beneath) mentioned brokers arrange residence loans with the goal of not transferring the mortgage for 5 to 10 years.

“If a dealer takes a long-term view on their buyer, and we get remunerated by the path to align ourselves with them long run, you need to place them in the fitting product on the proper time,” mentioned Michaels.

Customers who had taken out residence loans between 2021 and 2023 had been confronted with quickly rising rates of interest, however Michaels discovered that his brokers hadn’t wanted to maneuver purchasers to completely different banks for a greater deal.

“The banks have been very accommodating to the shopper, whether or not it’s a variable charge that’s solely ever elevated as quickly as they signed up, or it’s a hard and fast rate of interest that’s expired. There have been very trustworthy and thought-out efforts to provide that buyer the fitting charge on the proper time.”

Michaels mentioned refinancing inquiries had been excessive however the variety of clients transferring from one financial institution to a different had been beneath regular. This was as a result of the banks have been taking care of the shopper to retain them long run.

Deborah Brincat (pictured beneath), a franchisee at Aussie Parramatta, mentioned there weren’t many banks that informed her when a buyer was about to come back off a hard and fast charge.

“So who’s contacting this buyer?,” Brincat mentioned. “Is the financial institution contacting the shopper? Or am I, because the dealer who will get remunerated for this, contacting the shopper?

“I dislike when a buyer flicks me an e mail from a financial institution to say my fastened charge is coming off – that is the data that brokers want entry to.”

Brincat mentioned she needed to know when a hard and fast charge was expiring nicely forward of time, so she might discuss to the shopper and have some leeway if issues arose.

“I believe the communication piece round fastened charge is fascinating, as a result of as a dealer, I really feel prefer it’s my duty to be in entrance of my buyer and saying your fastened charge is coming off, let’s have that dialog. Are you snug? Are you okay? This is the speed that they’ve supplied.

“However, it’s troublesome to have that dialog if the revert charge shouldn’t be supplied to us.”

Responding to Brincat’s feedback, Ian Rakhit (pictured beneath), common supervisor third social gathering banking at Bankwest, mentioned the financial institution had responded in several methods.

“The first was how can we give the dealer all of the instruments that they should have the dialog? The visibility within the portal of your clients, the charges that they’ll transfer to, key dates like fastened charges, and so on.

“I believe it makes business sense for us to provide you that info, in addition to relationship-wise. You’re the purpose of contact for the shopper. We shouldn’t must pay you path and do your communication to clients, we should always respect your relationship.”

Bankwest had additionally decided which cohort of shoppers was most in danger, primarily based on serviceability on the time of utility and factoring in a number of charge rises.

Rakhit mentioned the financial institution notified brokers that these clients weren’t but in issue however they could need to ask them in the event that they have been OK.

“That’s a greater dialog coming from you [the broker] than coming from the financial institution.”

Bankwest had additionally checked out dealer welfare, as a result of brokers had excessive work ranges by the rate of interest cycle and have been dealing with burdened clients. The financial institution had allowed brokers to entry its high-quality inside worker help program by CommBank, acknowledging that 2023 had been a troublesome yr for brokers.

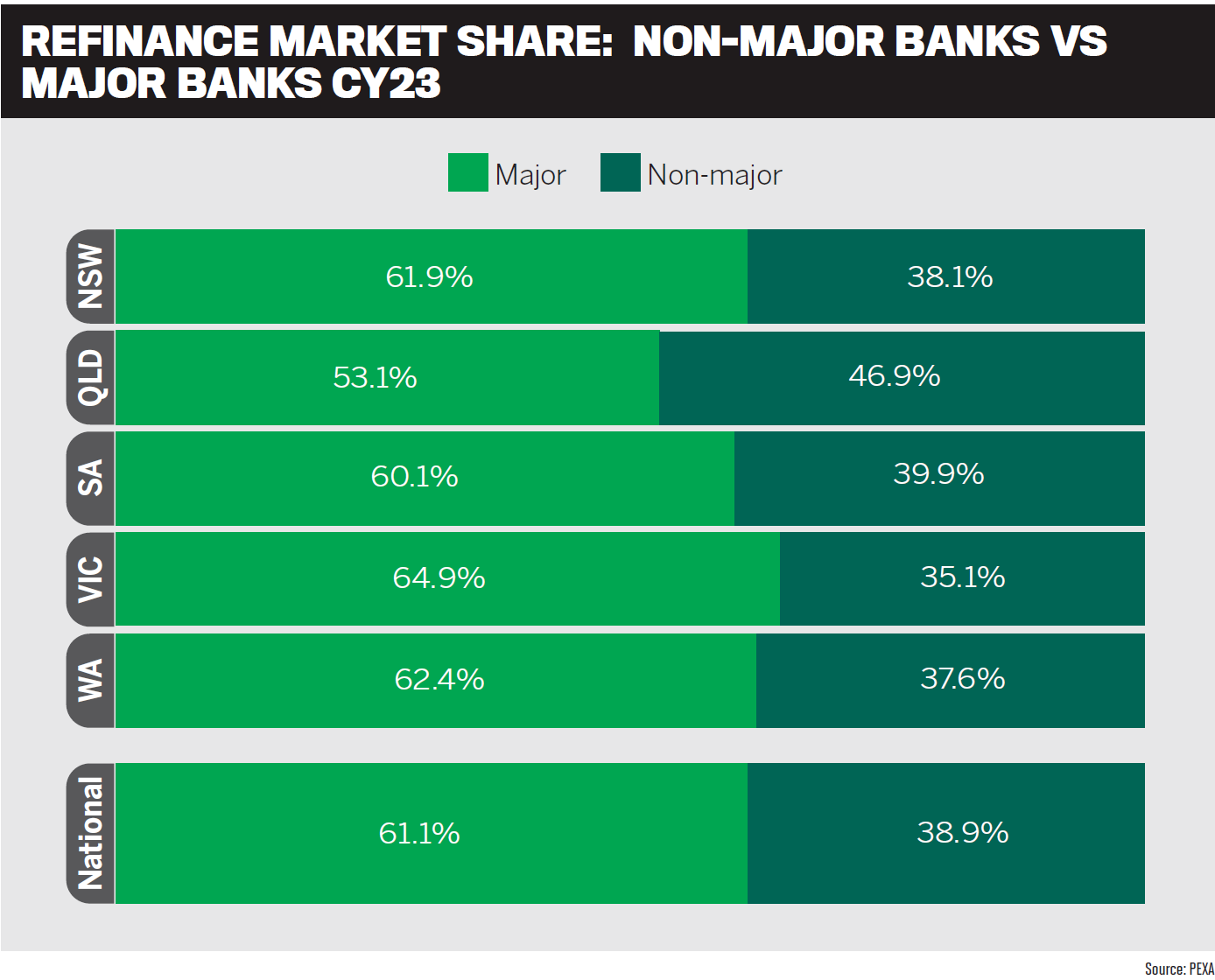

Looking on the broader market, Fedder mentioned there have been a number of different dynamics at play.

“Home mortgage system development got here down in 2023 – the entire was near 4%. In the previous, it’s been greater. To see that and to nonetheless see dealer companies maintain up signifies the expansion that brokers proceed to get pleasure from.

“Part of the profit is that a few of these brokers have moved in the direction of non-majors, rising our movement.”

Fedder mentioned he believed residence mortgage system development would slowly enhance this yr, thereby additional boosting dealer market share.

Q: How did non-major banks defend market share within the face of a extremely aggressive market? How essential is the dealer channel to your online business?

Herbert mentioned market share was fascinating, however “not all the time the principle recreation”.

He mentioned banks wanted to proceed to realize the fitting margin between the price of elevating capital and lending.

“If you don’t have worthwhile and profitable banks, it impacts stability and confidence within the banking system.”

Last yr, AMP Bank made some deliberate adjustments about the way it priced for brand spanking new and current clients to get the stability proper in managing margins.

“To pay attention, be taught and act on the suggestions from brokers has all the time been a central tenant to the experiences we ship,” mentioned Herbert.

“In 2023, we knew the necessity to proceed to carry service expertise was essential, supporting brokers as they navigated a difficult yr for his or her clients.”

The financial institution spent extra time working with key brokers to streamline the lending course of and help them and their clients to avoid wasting effort and time.

“At the beginning of 2023, we determined to essentially improve dealer expertise and increase the variety of individuals supporting brokers.”

Instead of getting a devoted contact centre, AMP Bank had dealer expertise workers hooked up to BDMs, responding to dealer’s emails and answering the telephone and build up that “repetitive information and relationship”.

“We discover that our dealer expertise crew get as many eventualities as our BDMs do, as a result of they’re accessible and have been capable of assist clear up an issue or enhance an expertise for a dealer or a buyer.”

“Maintaining dealer flows in our enterprise is de facto essential – greater than 90% of our enterprise comes from brokers. We’re a dealer first enterprise. Every time you do a prime up for a dealer mortgage, it may be $10,000 or $20,000, the fee continues to maintain rolling by, we don’t intervene or cease that.”

Herbert mentioned each communication or choice targeted on delivering for brokers.

“I believe the consistency and repair we delivered in 2023, even with some actually wild fluctuations in quantity, was by no means greater than 4 days to file. That’s the way you protect belief and popularity to constantly ship over the long run.”

Lockwood agreed, saying it was about getting the fitting stability between pursuing development and appropriately delivering “on our dedication to buyer (and workers) expertise, whereas additionally managing a aggressive market dynamic and stakeholder expectations”.

“Balance might be the important thing time period for lots of non-majors. It’s about being targeted as nicely – we aren’t a serious, we will’t do every little thing.”

Lockwood mentioned BOQ Group was priced competitively as a second-tier financial institution”.

“We’re going by fairly a big transformation on platforms… ME Bank [during this period] is the first platform for us in reaching great customer support and dealer service.

“We nail easy lending. If you’re coming by PAYG, low LVRs, the mortgage’s going to undergo in a number of days. We’re constantly rated by the aggregators as being on the prime by way of turnaround instances, expertise and repair.”

As a multi-brand organisation, the group additionally operates ME Bank, BOQ and Virgin Money.

While ME Bank targeted on easy, low LVR lending, BOQ had expertise in dealing with extra advanced lending, such because the self-employed, building and SME sectors.

“With confidence we will say to our brokers, ‘what sort of lending are you seeking to do’ – we’ve bought some great choices for you,” mentioned Lockwood.

Rakhit mentioned 90% of Bankwest’s lending now got here through brokers, up from 75% about 10 years in the past.

Bankwest introduced the closure of its WA department community not too long ago. It closed its east coast community between 2018 and 2022 and was focusing primarily on the dealer sector.

“We preserved and grew market share by focusing on retention. We couldn’t compete price-wise on new enterprise however we might do it on retention as a result of we don’t have the identical prices of acquisition.”

Rakhit mentioned Bankwest carried out strongly on retention by the dealer portal it had constructed and by permitting brokers to cost as they carried out their buyer opinions.

He mentioned 2024 could be completely different – the department closures meant the financial institution might worth in a different way and compete extra strongly.

Fedder mentioned Suncorp Bank’s journey had been an thrilling one, and it continued to develop sustainably.

“We proceed to focus on rising with extra brokers, and brokers which can be aligned to our buyer segments.”

Suncorp Bank’s method was to ask how its worth proposition may very well be aligned beneath greatest pursuits responsibility.

“How can we place the model in order that Suncorp Bank, for the fitting buyer, elevates in the direction of the highest of the menu?” mentioned Fedder.

Suncorp Bank had moved again in line with the market within the final three years, focusing on three issues.

The first was Suncorp Bank’s SunLight proposition, which sees decrease danger residence loans authorised inside 48 hours, and infrequently a lot quicker.

The second issue was competing on worth.

Thirdly and most significantly, mentioned Fedder, was taking friction out of the mortgage course of, particularly between utility and mortgage approval. “How can we work on being one of many extra constant lenders out there for pace to approval?”

Feedback from brokers had been essential to make sure Suncorp Bank remained aggressive as a non-major. Fedder mentioned the financial institution needed to make sure that when brokers selected Suncorp Bank, they might get the fitting pace to approval.

Rakhit requested the brokers on the roundtable whether or not they had pushed extra enterprise to non-majors within the final 5 years.

Brincat mentioned this was undoubtedly the case, as she discovered the key banks “troublesome within the service that they supply”.

She mentioned she had solely written one mortgage with one of many main banks within the final two years as a result of the service from the credit score crew was inconsistent.

“They [the bank] don’t come again to you in a well timed method, you discuss to at least one particular person, they’ll ask for this after which the file went to any person else,” Brincat mentioned. “There are some challenges when dealing with abroad operations groups. The expertise for me turned irritating as a result of I couldn’t decide to my buyer, as SLAs saved altering.”

Brincat mentioned for a time period, a lot of her enterprise had gone to Macquarie Bank as a result of they have been constant and simple to deal with.

“As their pricing elevated we had to take a look at different choices for our purchasers and you may get the identical stage of service from non-majors resembling Bankwest and ING – so that they got here into play for me.”

Rakhit mentioned all people was speaking about lifting their service proposition to brokers, as a result of non-majors didn’t have the identical model impression because the majors.

“We’ve all targeted on our service proposition to permit us to bridge that hole between ourselves and the majors.”

Michaels mentioned his brokerage had fairly a fair unfold between the large 4 banks, second-tier banks and non-bank lenders.

“But if I needed to name out a distinction between the majors and non-major lenders, the BDM assist is miles and miles forward with the non-majors.”

Michaels mentioned Catalyst Advisors had an excellent relationship with the key financial institution BDMs however the care issue with non-major BDMs actually shone by, acknowledging the great work of Winston Trinh at AMP Bank and Jude Schofield at Bankwest.

Brincat agreed with Michaels. She mentioned it wasn’t that main financial institution BDMs didn’t care about serving to brokers, it was the dearth of resourcing and incapability to escalate.

“We actually hero our BDMs and permit them that potential to win enterprise, defend their popularity. I ponder whether that’s true for greater organisations,” Rakhit mentioned.

Michaels mentioned when speaking to referral companions or clients, he informed them brokers have been in management when it got here to assessing clients and getting ready the appliance, however as soon as it went to the financial institution it was now not of their management.

“Our closest management inside a financial institution is through our BDMs or relationship managers. I genuinely can say that with non-big 4 financial institution NDMs, there’s extra love and a focus and care.”

Thompson mentioned all through 2023 ING elevated its mortgage lending guide above the speed of system development.

“We did this by simplifying credit score lending insurance policies, offering clients and brokers with extra choices. We additionally launched new LVR bands for buyers and launched a brand new on-line serviceability calculator that was straightforward to make use of.”

Q: Broker query from Deborah Brincat: What funding can we anticipate for brokers to have the ability to have knowledge wealthy details about their purchasers, particularly charges, time period expiry and stability? Some lender portals don’t present this info for present and historic purchasers

Brincat mentioned excluding Bankwest and some others which already supplied this info, she had zero visibility when it got here to her purchasers’ present mortgage charges and no potential to cost some current purchasers.

She mentioned this lack of expertise was infuriating and affected retention, particularly when doing anniversary calls with clients and having to ask them what their charge was.

The non-major banks’ credit score groups had actually lifted, offering extra consistency and communication, however when it got here to broker-facing groups and managing clients, enchancment was wanted.

Herbert mentioned he had heard these issues from brokers many instances and AMP Bank’s first precedence was to have the ability to present this info to brokers.

“You’ve bought to take a look at your platforms, your software program, the integrations you may have with your core banking techniques first, and what’s the pathway to get to that? Providing real-time pricing, a real-time view of your buyer portfolio, it must be completed.”

Herbert mentioned in December 2023, AMP Bank had created a web-based reprice kind which simply required brokers to supply their account particulars. Bots might present a response in minutes, which saved brokers time on repricing.

A retention specialist might additionally get involved with the dealer to debate the mortgage situation if wanted.

Referring to Michaels’ earlier remark about brokers controlling the expertise for the shopper up till mortgage submission, Herbert mentioned AMP Bank had been working exhausting to take away this concern from brokers and clients by creating the fitting platform and enhancing the front-end expertise.

It needed to evaluate loans utilizing the information brokers had already validated by display screen scraping and digital IDs and supply certainty to brokers that they might get a solution primarily based on the data they equipped.

When the dealer portal was accomplished, brokers would have the ability to take a look at their utility pipeline in actual time, together with notes on the method and any conversations and interactions with clients.

Herbert mentioned it was essential that AMP Bank labored collaboratively with brokers to supply info that may assist them with their clients.

Rakhit mentioned brokers might entry their current clients’ mortgage info within the Bankwest Broker Portal. He mentioned the portal was the results of time, cash and funding.

Closing its east coast financial institution branches in 2018 had freed up cash for funding in brokers.

“I believe the largest alternative now we have as leaders of third social gathering companies is influencing these conversations about the place do our banks make investments? It’s actually pleasing that we’re investing increasingly more in dealer options,” Rakhit mentioned.

Lockwood mentioned ME Bank, BOQ and Virgin Money all had dealer portals, together with a dealer pricing instrument which generally supplied an on the spot choice for on-line submissions; in different conditions it might need to be escalated.

“We recognise the significance of attempting that will help you handle your time. There’s no level you sitting on the telephone for one thing that may be completed instantly,” he mentioned.

Lockwood mentioned together with buyer knowledge within the dealer portal would make the method easier and BOQ Group was at the moment working on the safety elements. “Stay tuned.”

Fedder mentioned Suncorp Bank had already constructed its dealer portal, including within the knowledge of all clients from May 2023 onwards. Like different non-majors, the financial institution would take a look at the way to greatest pursue the continuing retention of shoppers.

“The incontrovertible fact that brokers see this as a vital space the place they add worth to clients signifies that we have to proceed to take a look at it,” mentioned Fedder.

Lockwood mentioned, “It’s less expensive for us to maintain an current buyer than it’s to amass a brand new buyer. We’d love all clients to remain and for all brokers to be glad.”

Q: Broker query from Stephen Michaels. What are your ideas on the large 4 banks and cases the place they obtain “particular remedy” compared to non-major banks? Example – the power to supply streamlined refinance evaluation (i.e. 1% buffer on prime of precise charge). Is this truthful? Are non-majors at an obstacle in relation to implementing credit score coverage adjustments?

Rakhit mentioned the three% buffer was a requirement set by APRA to assist accountable lending.

Some main banks supplied streamline loans with decrease ranges of documentation resembling dollar-for-dollar refinances.

Bankwest had supplied a 1% buffer on dollar-for-dollar refinances, however just for single owner-occupier or one funding property.

“We wanted to tell APRA that we’d put sure controls in place to make sure that we weren’t taking on enterprise or danger that may be detrimental to our requirements,” Rakhit mentioned.

Bankwest additionally needed to agree with APRA that it will solely enable a sure variety of these refinances, with the restrict reached in a short time.

Rakhit mentioned the non-majors ought to take a look at first residence patrons. ‘Mortgage prisoners’ was a typical time period however there have been plenty of ‘rental prisoners’ – potential first-time patrons who attributable to massive rents have been unable to avoid wasting sufficient for a deposit.

“In phrases of serviceability, the first-time patrons are in all probability paying the very best charge out there and you then put 3% on prime. That’s not essentially serving to us carry extra individuals into homeownership.”

Lockwood mentioned one of many frustrations for non-major banks on 1% buffer loans was that they have been coverage exceptions and infrequently didn’t stack up attributable to scale.

“When you’ve bought a lot decrease movement than a serious and a a lot smaller stability sheet, since you might need a really small allocation, then how do you handle that? Is that the form of danger you need?”

It was an unlevel enjoying subject for the non-majors in comparison with the majors as a result of scale did rely, mentioned Lockwood.

MPA requested Michaels if he believed the 1% buffer loans have been driving dealer enterprise to the majors.

Michaels mentioned this was completely the case. He gave an instance of a buyer with three properties in Sydney’s jap suburbs, totalling $3.5 million in loans within the portfolio.

“His borrowing capability going to a non 1% buffer financial institution was a most borrowing for the family of $2.2 million,” he mentioned. “It was a $1.3 million distinction in borrowing.”

Brincat mentioned that it was primarily buyers who have been lacking out on the 1% buffer alternatives, attributable to coverage standards.

“They’re already getting hamstrung round charge. They’ve bought a number of properties and are clearly capable of service their debt – what’s the danger? Particularly when LVRs are sub-80%.”

Rakhit mentioned all non-majors could be happy with the low stage of arrears, given two years of COVID and 13 charge rises.

“Our stage of arrears could be very, very low. Now this may very well be as a result of 3% buffer.”

Lockwood mentioned this was an excellent level.

“The Australian economic system and banking atmosphere might be probably the most secure and dependable on the earth – it’s the partnership between banks and the regulators and the commitments that now we have.”

Q: What are your plans to improve expertise in 2024 and the way will they enhance techniques and processes for brokers and their clients? What half does AI should play?

Fedder mentioned Suncorp Bank has a strategic partnership with NextGen and they might proceed to work collectively, investing in pace from utility by to unconditional approval.

“For me, it’s that constant method – the way you get quicker and quicker and take the friction out of the mannequin. We’re reflecting on what now we have completed prior to now and we’re persevering with to ask for dealer suggestions round how we will make that even higher.”

Herbert mentioned pace was an fascinating level. “You could be quick, however wanting again on the worth chain, how can we scale back effort? Effort for the dealer, effort for the shopper. How can we take away duplication of effort?”

AMP Bank was eager to enhance brokers’ confidence in a lending final result.

“Brokers commonly inform us they worth the power to regulate and have visibility of the expertise for his or her clients all through the house mortgage journey, nonetheless this usually breaks down as soon as a mortgage is submitted,” Herbert mentioned.

“Providing larger confidence in outcomes earlier than a mortgage is submitted is a crucial step change we see essential to assist tackle this, and delivering a number one utility expertise for our brokers and their clients that provides great confidence within the final result upfront is a precedence.”

Herbert mentioned there have been plenty of instruments together with propensity modelling and AI that would assist. More essential have been the digital instruments brokers used to supply info that may very well be utilized by the lenders moderately than duplicating the trouble already undertaken.

Brincat mentioned plenty of this got here again to banks working with aggregators which supplied great expertise. She gave the instance of Lendi Group, which was working on an approval confidence function.

“So because of this we will put the information within the system, and as soon as the information is correct, the system will have the ability to inform us what’s the probability of that approval occurring. The work being completed with aggregators helps us as brokers, particularly if that may be the one-stop store.”

Brincat mentioned many brokers additionally used Quickli attributable to its accuracy earlier than going to a lender.

Michaels mentioned he additionally used Quickli to streamline the method and get to the fitting final result.

Rakhit mentioned sooner or later loans may very well be authorised at time of lodgement. This would contain revalidating info brokers supplied utilizing knowledge factors as an alternative of paperwork.

Bankwest was excited to introduce its first AI instrument, which helped brokers when utilizing the financial institution’s library of credit score coverage.

“You put in sure search info, and AI will carry that info to the fore moderately than you having to go and discover it.”

Rakhit mentioned AI was ultimate for repeatable duties and the plan was to increase its use.

Bankwest had additionally spoken to Quickli, which might present “an incredible stage of knowledge on opponents, how they worth, how they service, what they put into their serviceability catalogue”.

Rakhit mentioned there have been additionally different great tech corporations resembling CoreLogic, illion and Equifax that the business might spend money on and the subsequent few years could be thrilling.

ING was digitising and automating the shopper journey and evaluation course of to create quicker extra streamlined buyer experiences, Thompson mentioned. “Digital validation of utility paperwork is an instance. AI is seen more and more as a core functionality and alternative.”

Lockwood mentioned 2024 could be an enormous yr for BOQ Group by way of expertise transformation.

“One of the biggest investments that the financial institution has made ever is in a brand new residence mortgage program,” he mentioned.

BOQ group had launched a greenfield digital financial institution a number of years in the past that includes all three manufacturers, Virgin Money, BOQ and ME Bank.