Australia’s top investment hotspots revealed | Australian Broker News

News

Australia’s top investment hotspots revealed

Capital development meets excessive yields

The newest findings from Washington Brown and Hotspotting revealed a listing of top places the place property buyers can discover the best mix of capital development and excessive rental yields.

These areas profit from sturdy native economies and low emptiness charges, making them prime targets for savvy buyers searching for worthwhile alternatives.

Exceptional market performers

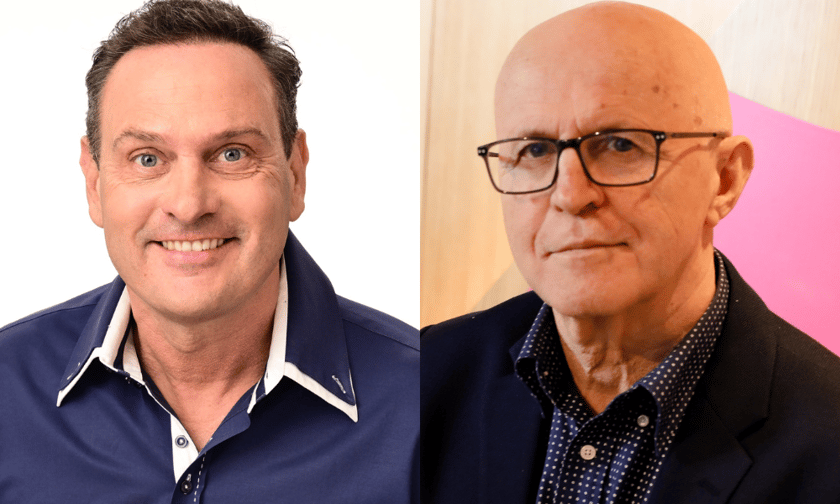

Tyron Hyde (pictured above left), director of Washington Brown, highlighted the distinctive efficiency of particular markets.

“Among essentially the most excellent performers recognized by this report are places the place property values have risen notably, however rental yields have elevated as a result of there was an distinctive enhance in rents,” Hyde mentioned.

Notably, the city of Dalby in Queensland and Murray Bridge in South Australia have proven vital will increase in each property values and rental yields.

Highlighting top performers: Dalby and Murray Bridge

Dalby, a key regional middle in Queensland, has seen a dramatic rise in rents by 24% over the previous 12 months, pushing the median rental yield from 6.6% to 7.2%.

Similarly, in Murray Bridge, rents have surged by 27%, with property values climbing sharply.

“With vacancies close to zero, these areas are displaying great development in each rental revenue and property worth,” Hyde mentioned.

Depreciation advantages add to investor enchantment

The monetary benefits lengthen past typical investment returns.

“In Murray Bridge and Armadale, buyers might declare vital depreciation advantages, which might probably produce a taxation profit relying on their private revenue tax charge,” Hyde mentioned.

Top 10 places detailed

The report listed top places like Dalby, Murray Bridge, and Armadale amongst others, every displaying sturdy capital development and excessive rental yields, complemented by native financial energy and low emptiness charges.

Here’s the top 10 record.

Vacancy charge: 0.1%

Rent enhance: 24% over 12 months

Median home worth: Up 15% to $350,000

2. Murray Bridge, South Australia

Vacancy charge: 0.4%

Rent enhance: 27% over 12 months

Median home worth: Up 22% to $415,000

3. Armadale, Western Australia

Vacancy charge: 0.4%

Rent enhance: 26% over 12 months

Median home worth: Up 31% to $420,000

4. Bowen Hills (items), Queensland

Vacancy charge: 1.2%

Rent enhance: 15% over 12 months

Median unit worth: Up 7.1% to $455,000

5. Yorkeys Knob (items), Queensland

Vacancy charge: 0.7%

Rent enhance: 11% over 12 months

Median unit worth: Up 15% to $340,000

6. Balga, Western Australia

Vacancy charge: 0.1%

Rent enhance: 22% over 12 months

Median home worth: Up 22% to $465,000

7. Woodridge (items), Queensland

Vacancy charge: 0.6%

Rent enhance: 15% over 12 months

Median unit worth: Up 24% to $298,000

8. Carey Park, Western Australia

Vacancy charge: 0.6%

Rent enhance: 15% over 12 months

Median home worth: Up 23% to $370,000

9. Bundaberg South, Queensland

Vacancy charge: 0.8%

Rent enhance: 20% over 12 months

Median home worth: Up 6% to $370,000

10. Geraldton, Western Australia

Vacancy charge: 0.8%

Rent enhance: 23% over 12 months

Median home worth: Up 11.6% to $355,000

“These places not solely present sturdy rental returns but in addition maintain potential for capital appreciation attributable to ongoing regional improvement and financial elements,” mentioned Terry Ryder (pictured above proper), Hotspotting director.

Economic drivers and native advantages

Each top-performing location has its distinctive financial drivers, from pure assets and manufacturing to healthcare and retail. These industries not solely gasoline the native financial system but in addition present considerable employment alternatives, additional strengthening the rental and property markets.

Long-term investment outlook

The report recommended a constructive long-term outlook for these areas, with anticipated inhabitants development and continued financial improvement making them engaging for each first-time homebuyers and seasoned buyers.

“The strategic location and financial circumstances in these areas make them extremely fascinating for long-term investment,” Hyde mentioned.

Get the most popular and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE day by day e-newsletter.

Related Stories

Keep up with the newest information and occasions

Join our mailing record, it’s free!