When it involves promoting a dwelling, atmosphere the right sale price ticket is an individual of essentially the most important decisions. Not solely does a property’s sale fee dictate how a lot you stand to monetary achieve, however it may possibly additionally influence how shortly a property strikes off the market place. As residence is taken into account a single of the key sources of wealth in Australia, with the attainable to expertise vital financial rewards, use these insightful pointers to make sure your residence sells for the easiest worth possible within the shortest quantity of time.

Suggestion 1: Know Your Land and Property Price

Ahead of itemizing your own home for sale, it’s vital to appraise how a lot your land and residential is admittedly price. Contemplating elements some of these as sizing, slope, topography, and spot to determine the land price:

Use no price on line belongings like all these made obtainable by Harcourts which makes use of knowledge this sort of as group property itemizing promoting costs and new income info to supply a cost-free market appraisal.

Get a property profit estimate from an skilled home appraiser to get a definite data of what your family is admittedly price within the newest present market.

Check with with an area real property agent to get useful insights into setting a sensible product sales worth.

Idea 2: Look at New Revenue and Listings

Monitoring present-day listings and fashionable earnings in your neighbourhood will help you get an technique of what comparative homes are promoting for. Use on the web platforms to analyse itemizing background and gauge how {the marketplace} executed in a purchaser’s trade vs. a vendor’s trade. Shell out shut curiosity to properties with very related traits to your have, and take into consideration elements equivalent to age, attributes, sq. footage, and trend to much more refine your pricing technique.

Idea 3: Analyse Conclusions and Set the Price

Soon after gathering and analysing historic product gross sales information, evaluating not way back bought houses together with your very personal, and consulting together with your precise property agent, it may be time to ascertain your sale promoting value. You would possibly need to facet in a slight buffer for potential negotiations with clients, whereas nonetheless aligning your value with newest gross sales figures of equal properties in your spot. Maintain in mind that, finally, market dynamics will determine your property’s reputable price, so proceed to be educated about present market tendencies and product gross sales information to maximise your sale price ticket.

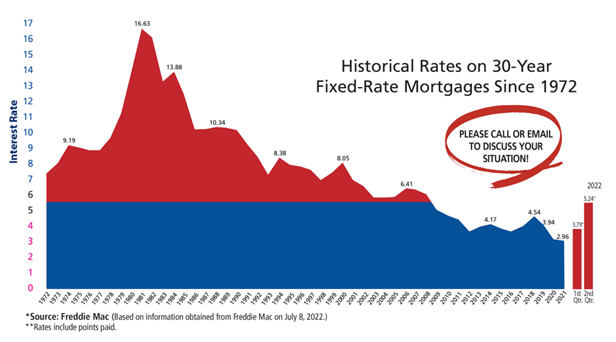

Idea 4: Discover Financing Solutions with Your Mortgage Broker

When your sale promoting value is established, talk about financing decisions for your subsequent dwelling spend money on. Reach out to your Home mortgage Categorical dealer to get mortgage mortgage recommendation for your new home or a bridging monetary mortgage to finance the purchase of a brand new property when your current family is presently being bought.

Confidently Navigate the Assets Sale Process

Offering a home is a big choice and setting the appropriate sale value is usually a subtle plan of action. With professional recommendation out of your true property agent and residential finance mortgage strategies from your own home finance mortgage dealer, it’s possible to confidently set the best sale promoting value so your own home sells within the shortest attainable time. For extra finance or mortgage recommendation personalised to your distinctive cases and predicament, get involved with a house finance mortgage dealer from Home mortgage Specific.

While all remedy has been taken within the preparation of this publication, no assure is obtainable as to the accuracy of the knowledge and info and no accountability is taken by Finservice Pty Ltd (Mortgage Categorical) for any errors or omissions. This publication doesn’t signify personalised financial recommendation. It could maybe not be related to distinctive state of affairs. Nothing on this publication is, or actually needs to be taken as, an provide, invitation, or advice to acquire, market, or retain any monetary funding in or make any deposit with any individual. You actually ought to look for expert data simply earlier than utilizing any motion in relation to the problems dealt inside this publication. A Disclosure Assertion is on the market on ask for and no price of price.

Finservice Pty Ltd (Mortgage Express) is authorised as an organization credit score historical past marketing consultant (Company Credit score Representative Variety 397386) to have interaction in credit score rating actions on behalf of BLSSA Pty Ltd (Australian Credit score Licence quantity 391237) ACN 123 600 000 | Entire member of MFAA | Member of Australian Fiscal Issues Authority (AFCA) | Member of Option Aggregation Products and providers.