As the conclusion of the financial calendar year (EOFY) methods, it’s actually vital to simply take proactive methods to make sure you occur to be making probably the most of out there tax beneficial properties. Regardless of whether or not you may be an distinctive taxpayer, small enterprise operator, or investor, EOFY is after we wrap up the newest fiscal calendar year, complete bookkeeping duties, lodge tax returns, and put collectively for the brand new financial year. Set by yourself up for financial outcomes with these important tax suggestions for conclusion of fiscal year.

Evaluation Your Finances

Choose a intensive glimpse at your financial situation, which embody your income, bills, and investments.

Take into consideration any money beneficial properties or losses from investments, as these can affect your tax legal responsibility.

Speak to a finance professional to get assist assessing your general fiscal well being and health so you can also make educated choices.

Claim All Deductions and Concessions

Familiarise by yourself with the quite a few tax deductions and concessions provided to you, these sorts of as operate-connected expenditures, residence workplace atmosphere prices, educational charges, charitable donations, and explicit superannuation contributions.

For compact enterprise householders, an quick tax deduction might maybe be accessible for depreciating property costing a lot lower than $20,000 and obtained amongst 1 July 2023 and 30 June 2024.

Maintain intensive paperwork of your prices and make sure you fulfill the eligibility necessities for claiming deductions.

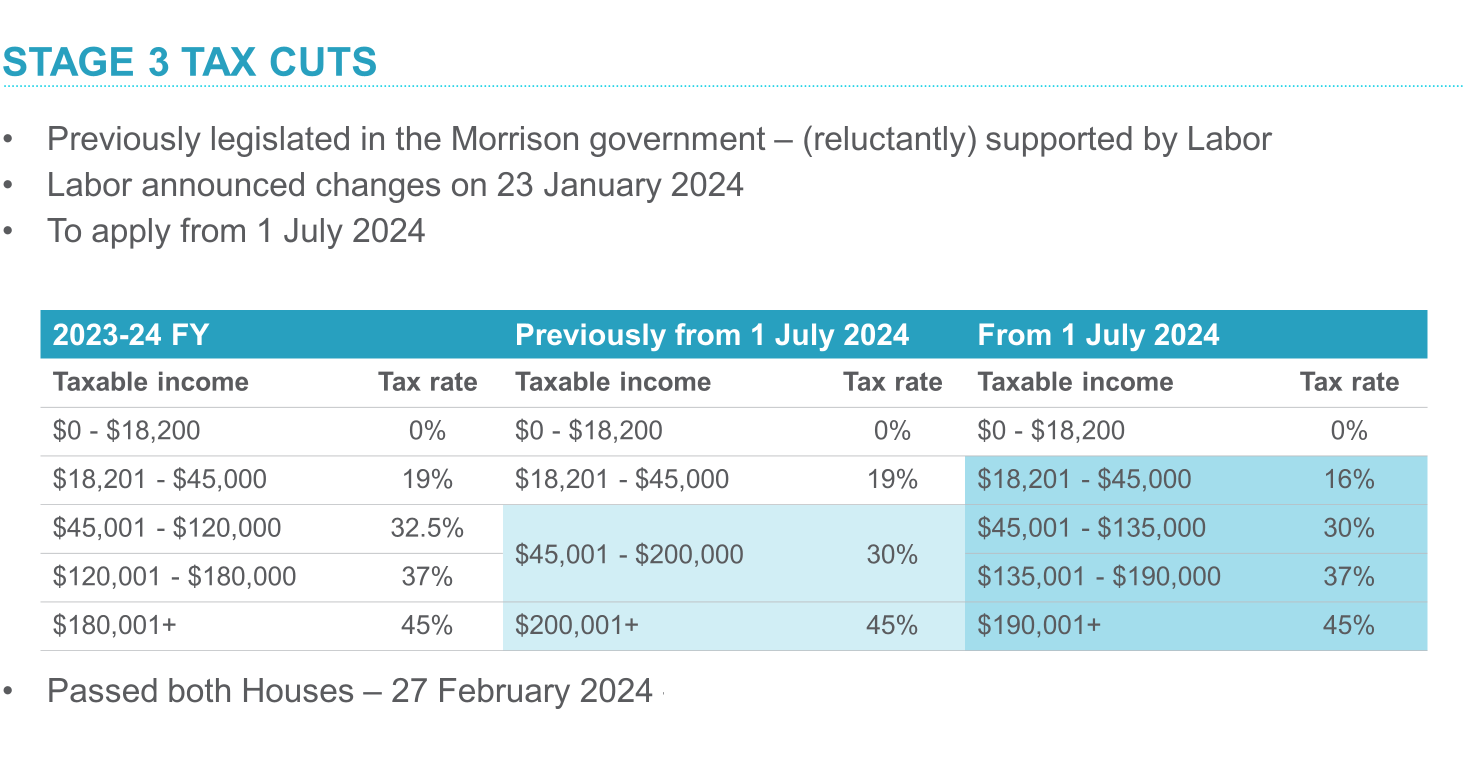

Continue to be Knowledgeable About Tax Alterations

Hold as much as day with any enhancements to tax authorized tips or rules that will maybe results your tax obligations.

Monitor federal authorities bulletins and updates from the Australian Taxation Place of work (ATO) to ensure compliance with current conditions.

Have interplay a Registered Tax Agent

Review Your Enterprise Construction

If you’re a enterprise proprietor, assess your newest small enterprise framework to make sure it nonetheless aligns along with your fiscal plans and targets.

Take into consideration the tax implications and asset security rewards of distinctive enterprise enterprise buildings, this type of as sole dealer, agency, partnership, or believe in.

Consult with a enterprise adviser or your accountant to ascertain probably the most acceptable framework in your firm wants and upcoming enlargement applications.

Beware of Tax Refund Cons

Be cautious of any unsolicited emails, cell phone calls, or textual content messages declaring to supply big tax refunds.

Scammers usually concentrate on people within the course of tax interval, posing as govt companies or tax authorities to steal explicit particulars or revenue.

Verify the legitimacy of any communications by making contact with the associated tax authority straight or consulting with a trusted finance information.

Examine Your Organization and Marketing and promoting Ideas

Get this chance to evaluate your small business goals, aims, and advertising and promoting procedures, and purchase a strategic strategy for the approaching year.

Analyse your effectivity greater than the sooner fiscal 12 months and decide components for development or progress.

Look at Your Insurances

Vital Dates

June 30 is EOFY in Australia, so strategy forward to meet any submitting deadlines or reporting calls for.

Use digital devices or calendar reminders to proceed to be on greatest of essential dates and keep away from any past-minute hurry or penalties for non-compliance.

EOFY is an vital time for organizations and women and men alike. By taking proactive strategies now, you may be perfectly-well ready for the brand new fiscal yr. Get financial solutions from a Mortgage mortgage Convey finance marketing consultant or search for expert tax steerage from a registered tax agent who can tailor suggestions to your exact scenario and allow you make educated choices.

While all therapy has been taken within the planning of this publication, no guarantee is equipped as to the precision of the data and no accountability is taken by Finservice Pty Ltd (Property finance mortgage Convey) for any errors or omissions. This publication doesn’t signify personalised cash info. It might maybe not be associated to explicit individual conditions. Nothing on this publication is, or must be taken as, an present, invitation, or suggestion to put money into, market, or hold any monetary funding in or make any deposit with any particular person. You should request skilled solutions earlier than having any motion in relation to the issues dealt in simply this publication. A Disclosure Statement is on the market on request and completely free of value.

Finservice Pty Ltd (Home mortgage Specific) is authorised as an organization credit score rating agent (Company Credit historical past Consultant Amount 397386) to have interaction in credit standing issues to do on behalf of BLSSA Pty Ltd (Australian Credit rating Licence vary 391237) ACN 123 600 000 | Total member of MFAA | Member of Australian Fiscal Grievances Authority (AFCA) | Member of Alternative Aggregation Services.